How much of an impact has the COVID-19 crisis had on sports teams’ 2020 sports tech budget? When do sports teams plan to invest again in sports tech?

These are the types of questions that we asked 31 sports teams, as part of our new Upside survey. In this article we summarized the key results of our survey.

It was apparent that in the past few weeks because of the COVID-19 crisis many sports teams, many of the teams and leagues that we work with, have been impacted financially. One of the most critical areas is sports technology.

As a result of the COVID-19 many sports teams had to revise their 2020 sports tech budget and plan to invest in technologies (GPS, wearables, HR monitor..) in 2020 and beyond.

WHAT WE DECIDED TO DO

In a quick turnaround, over the past 2 weeks we sent out a survey to athletic staff members of a large number of sports teams around the world.

The goal was to understand the impact of COVID-19 on the sports teams’ 2020 sports tech budget, which areas of sports were financially impacted, when they were now planning to invest in sports technologies, and in which types of emerging sports technologies they were planning to invest.

Respondents represented 31 different sports, from pro teams & organizations, including the MLS, NBA, NFL, NHL, MLB, Division 1 NCAA teams, European soccer teams and leagues (English Premier League), South American soccer leagues (Brazilian First division..), as well as healthcare organizations. Of note, we would like to thank all the teams and coaches that participated in this survey. We also like to acknowledge Innovate AT for its contribution to this survey as a tech partner. We would also like to personally thank Daniel Hayes (LA Dodgers), Skylar Richards (Orlando City FC/MLS), Derek Lawrance (SJ Earthquakes/MLS), Brian Lee (LA Children’s hospital), Leonard Zaichkowsky, and Manoel Coutinho (Botafogo FR) for their help making this survey a success. This is a follow up to our recent article gathering testimonials from Top coaches/trainers/Startups on what to do during COVID-19 crisis.

COVID-19 impacted Teams’ 2020 Sports tech budget

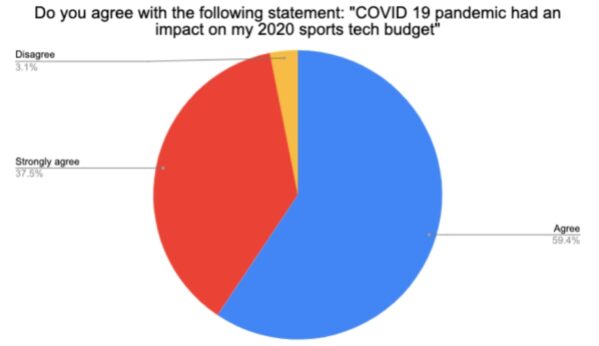

97% OF ATHLETIC TRAINERS AGREED THAT COVID-19 IMPACTED THEIR 2020 SPORTS TECH BUDGET

Over the past few weeks, many sports teams cut salaries of players and staff members sometimes by up to 50% in order to mitigate the impact of the COVID-19 on their top line and bottom line.

With that in mind, it was not a surprise to see that 97% of respondents agreed or strongly agreed that the COVID-19 crisis impacted their 2020 sports tech budget. Only 3% of the respondents said that the COVID-19 crisis had no impact on their 2020 sports tech budget.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

So the next question became: To what extend was your 2020 sports tech budget impacted?

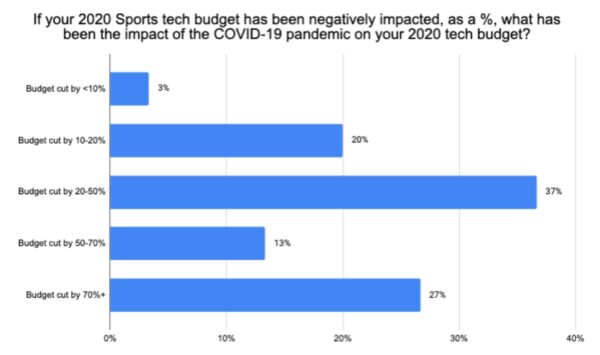

37% OF COACHES’ 2020 SPORTS TECH BUDGET GOT CUT BY 20-50%.

As shown in the graph below, 37% of the athletic trainers surveyed reported a 20-50% cut on their 2020 sports tech budget. In addition, 13% of athletic trainers indicated a 50-70% budget cut, 20% of them reported a 10%-20% cut, and 27% of them reported a 70% budget cut. With that in mind it is fair to say that for most teams their 2020 sports tech budget got impacted by the COVID-19 crisis.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

COVID-19 impact on Teams’ 2020 Sports tech budget By Technology

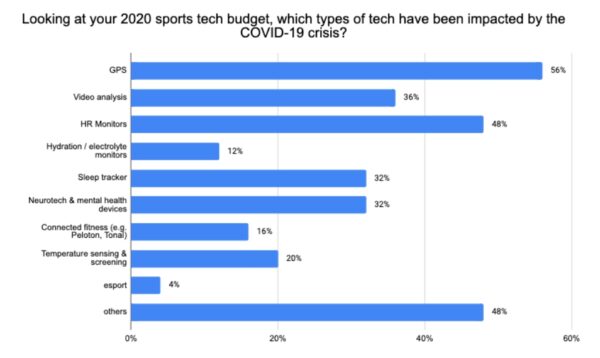

GPS SYSTEMS AND HR MONITORING SYSTEMS GOT MOST IMPACTED BY COVID-19 CRISIS

Budgets allocated towards GPS and HR monitors were the most impacted by the COVID-19 crisis. In fact, as shown in the chart below, 56% of athletic trainers indicated that their budget allocated towards GPS systems got impacted while 48% reported that budget for HR monitors got impacted by the crisis. This makes sense as GPS and HR monitors are among the most popular types of technologies currently used by sports teams.

Other types of technologies that got impacted by COVID-19 were video analysis systems (36%), sleep trackers (32%), neurotech & mental health devices (32%), temperature screening & sensing solutions (20%), connected fitness equipments and solutions (16%), hydration/electrolyte monitoring solutions (12%), and esport equipments and solutions (4%).

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

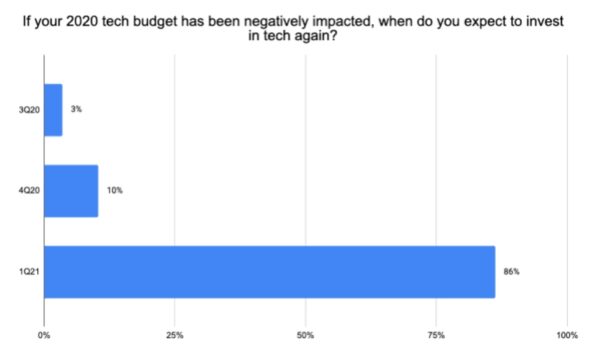

86% OF ATHLETIC TRAINERS PLAN TO INVEST AGAIN IN NEW SPORTS TECHNOLOGIES IN 1Q21

As shown in the graph below, given the low visibility on the future outlook, it was not surprising to see that 86% of the athletic trainers we surveyed indicated that they planned to invest in new sports technologies not until 1Q21. That being said, on the bright side, 10% of the athletic trainers said that they planned to invest in new tech in 4Q20. 3% of the even indicated that they planned to buy new technologies as early as 3Q20.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

Teams’ 2020 Sports tech Plan to Invest in New Technologies

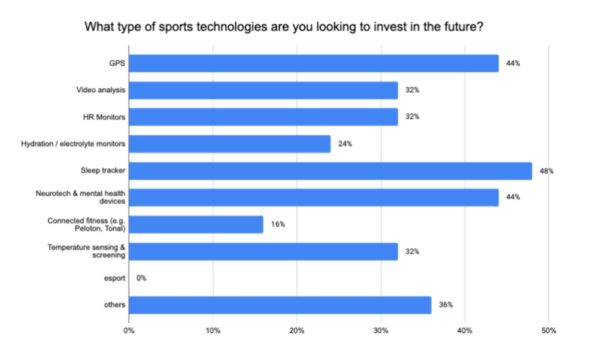

48% OF ATHLETIC TRAINERS PLAN TO INVEST IN SLEEP TRACKERS VS 44% IN GPS VS 44% IN NEUROTECH & MENTAL HEALTH

As shown in the graph below, 48% of the athletic trainers we surveyed indicated that they plan to invest in sleep trackers in the future. GPS systems remained a top priority moving forward with 44% of the athletic trainers planning to invest in GPS systems while 44% of them planned to invest in neurotech & mental health devices. This does not come as a surprise as being on quarantine likely affected some players mentally and trainers want to make sure that they can address any mental issues moving forward. 32% of them also planned to invest in HR monitors and video analysis systems. 32% of the athletic trainers also planned to invest in temperature sensing & screening solutions. This makes sense as many sports leagues plan to do temperature screening of players before each games when the competition resumes.

Hydration/electrolyte monitoring solutions also gathered a lot of interest with 24% of the respondents indicating their plan to buy hydration/electrolyte monitoring solutions. Lastly, 16% of athletic trainers also indicated their plan to invest in connected fitness (Peloton, Tonal..) in the future.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

57% OF ATHLETIC TRAINERS’ SPORTS TECH BUDGET WAS <$50K VS 27% IN THE $50K-$100K RANGE

Over the years, through the Sports Tech Advisors and Upside we have worked with many sports tech startups whose most common question is: “What is the sports teams’ sports tech budget? How much do they plan to spend in a given year?

Typically sports tech budgets vary depending on the sports league and teams that coaches, trainers and athletic trainers work for. Generally speaking, pro teams (NBA, NFL NHL, EPL..) tend to have bigger sports tech budget than college teams (NCAA).

As shown in the graph below, 57% of the athletic trainers we surveyed indicated that their 2020 sports tech budget was less than $50K. However, 27% of the athletic trainers reported that their 2020 sports tech budget was within the $50K-$100K range. And 17% of them reported a 2020 sports tech budget above $200K.

This is critical for tech vendors to know as typically a GPS system like Catapult will cost teams about $40K per year. So if a team plan to invest in a GPS system as well as a sleep tracking system and only has $50K in budget to invest in new sports technologies, it quickly become problematic especially in the challenging macro environment we are currently living in.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

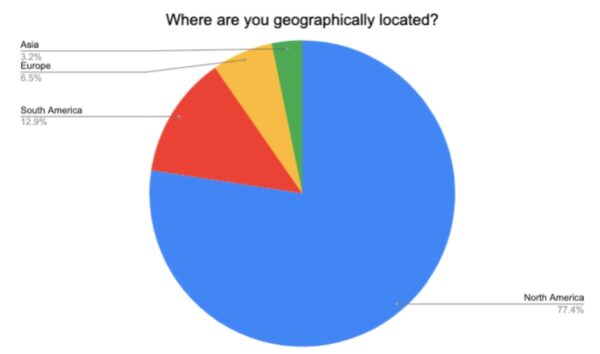

77% OF ATHLETIC TRAINERS SURVEYED WORKED FOR NORTH AMERICAN TEAMS

As shown in the table below, 77% of the athletic trainers who participated in this survey worked for teams and organizations in North America, vs 13% in South America, vs 6% in Europe and 3% in Asia.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

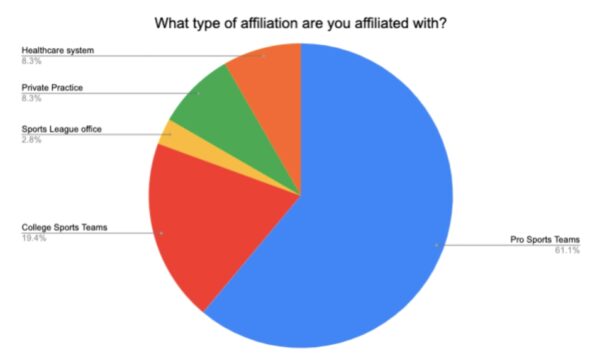

61% OF ATHLETIC TRAINERS SURVEYED WORKED FOR PROFESSIONAL TEAMS

As shown in the table below, 61% of the athletic trainers who were part of this survey worked for professional teams, vs 19% for college sports teams. 8% of respondents also worked or healthcare companies while 8% of them worked for private practices and 3% of them worked for sports leagues.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

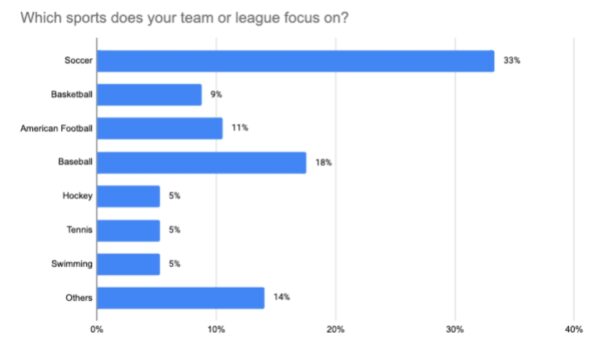

33% OF ATHLETIC TRAINERS SURVEYED WORKED FOR SOCCER TEAMS

As shown in the table below, 33% of the athletic trainers who participated in this survey worked for soccer teams, vs 18% for baseball teams, vs 11% for American Football teams and 9% for basketball teams.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

BOTTOM LINE

Not surprisingly the COVID-19 crisis has impacted most sports teams, leagues and healthcare organizations. 97% of respondents agreed or strongly agreed that the COVID-19 crisis impacted their 2020 sports tech budget.

Here are the other key takeaways:

- Teams experienced budget cut anywhere from 20-50% all the way up to 70%: 37% of the athletic trainers surveyed reported a 20-50% cut on their 2020 sports tech budget. In addition, 13% of athletic trainers indicated a 50-70% budget cut and 27% of the them reported a 70% budget cut. Lastly 20% of them reported a 10%-20% budget cut.

- Budgets allocated towards GPS and HR monitors were so most impacted by the COVID-19 crisis: 56% of athletic trainers indicated that their budget allocated towards GPS systems got impacted while 48% reported that budget towards HR monitors got impacted by the crisis.

- 86% of the athletic trainers we surveyed indicated that they plan to invest in new sports technologies not until 1Q21. That being said, on the bright side, 10% of the athletic trainers reported their plan to invest in new tech in 4Q20.3% of the even indicated that they planned to invest in new technologies as early as 3Q20.

- 48% of the athletic trainers we surveyed indicated that they plan to invest in sleep trackers in the future. GPS systems also remained a top priority moving forward with 44% of the athletic trainers planning to invest in GPS systems while 44% of them planned to invest in neurotech & mental health devices.

- 57% of athletic trainers’ 2020 sports tech budget was <$50K Vs 27% in the $50k-$100k range: Of note, only 17% of them indicated that their budget was above the $200K.

On the bright side it is worth pointing out that some of the teams who participated in our survey indicated that their 2020 sports tech budget was not impacted by the COVID-19 crisis. In our opinion, coaches have handled the COVID-19 crisis very well and adapted their training techniques to make sure that their players remain in shape physically and mentally. This is where sports technologies (wearables, fitness equipment, neurotech, sleep tech..) remain vital to keep track of players’ health (physically and mentally), prevent any potential health issues and enable players to be in control of their own health. At the end of the day, the future of the sports tech industry is bright and we are coming across new innovative technologies every day. So there is a lot to look forward to.

If you liked this type of Upside analyses, and if you are a head athletic trainer, CTO, CMO of a major sports team or league looking to connect with the most innovative startups or connect with your peers to network, or if you are a startup CEO looking to connect with top teams or investors, you can join the Upside community of executives from the NBA, NFL, NHL, MLS, MLB, Laliga, English Premiere League, Olympic teams, top VCs, startups (AR, VR, wearables, sleep tech..) and more!

Our partners Upside Global are now launching their new platform to bring together their sports, tech & health community of 2,500 executives under a single web platform. Members include executives from the NBA, NFL, NHL, MLS, MLB, Laliga, English Premiere League, Ligue 1, Bundesliga, Series A, Brazilian soccer league, Olympic teams, Pro tennis, as well as representatives of startups, brands, VCs, and athletes.

Your opportunity for growth starts now, create your free executive profile today to join our online community and click on “become a member today” as a first step. It is free to join! It only take one minute to create your profile.